Beating Yourself Up Over Money? Here Is How to Fix It (According to Reddit)

Have you ever looked at your bank account and felt a knot in your stomach? maybe you looked at a student loan bill and realized it was way bigger than…

Discover smart strategies for saving, investing, and growing your wealth. Practical insights you can use today.

Our top picks for you

Have you ever looked at your bank account and felt a knot in your stomach? maybe you looked at a student loan bill and realized it was way bigger than…

Have you ever tried to use your Amex card and been told, “Sorry, we don’t take American Express”? You’re not alone. A recent Reddit thread blew up with users asking…

For Singaporean families seeking everyday savings, the OCBC Platinum Credit Card positions itself as a versatile lifestyle companion. But does it deliver value in 2025’s competitive landscape? We dissect its…

Stay up to date with our newest content

For Singaporeans, choosing a credit card can be challenging. Do you want a travel rewards card or a cashback card? Today, we compare two popular options: In this post, we…

The integration of Artificial Intelligence (AI) in graphic design has sparked debates on whether AI tools can replace human graphic designers. While AI has made significant advancements in generating designs,…

By leveraging innovation and policy updates, the EB-3 visa is becoming a cornerstone of U.S. workforce stability. The EB-3 Visa’s Role in Addressing Labor Shortages The U.S. labor market continues…

This story comes from a Reddit post on the r/trustwalletcommunity forum. One user shared his very difficult experience when his Coinbase account was closed after he made a swap on…

A recent incident on Reddit has caught the attention of many in the crypto community. A user from the r/sgcrypto forum reported a frustrating experience with Coinbase during a CNY…

Singapore is a global leader in digital finance, with a booming crypto market. But not all platforms here are safe or reliable. Choosing the wrong one can lead to lost…

Millennials face a financial landscape unlike any previous generation. Debt from student loans, a changing employment market, and growing digital investment activity have produced a complex financial environment. At the…

I have always looked for ways to get more out of my business spending. When I discovered the American Express Singapore Airlines Business Credit Card, I saw an opportunity to…

![England’s Bachelor-Level Tuition Surpasses the U.S. [Infographics]](https://blog.ratex.co/wp-content/uploads/2025/01/Tuition.webp)

The cost of higher education has been a major concern for students and families worldwide, influencing career choices, financial planning, and overall accessibility to education. According to recent data from…

Taking short trips on weekends is one of the best ways to relax and de-stress from work. People in Western Maharashtra are fortunate to have easy access to the coastal…

Kevin Samuels was a prominent American image consultant, YouTuber, and social media influencer who gained widespread recognition for his discussions on relationships, lifestyle, and societal issues. At the time of…

As the cryptocurrency market prepares for its next surge, investors are positioning themselves to take advantage of the upcoming bull run. With altcoins and meme coins gaining momentum, this cycle…

Let me tell you about Vera Steward. She’s one of those people who lights up a room with her laughter, the kind that bubbles up from her chest and spills…

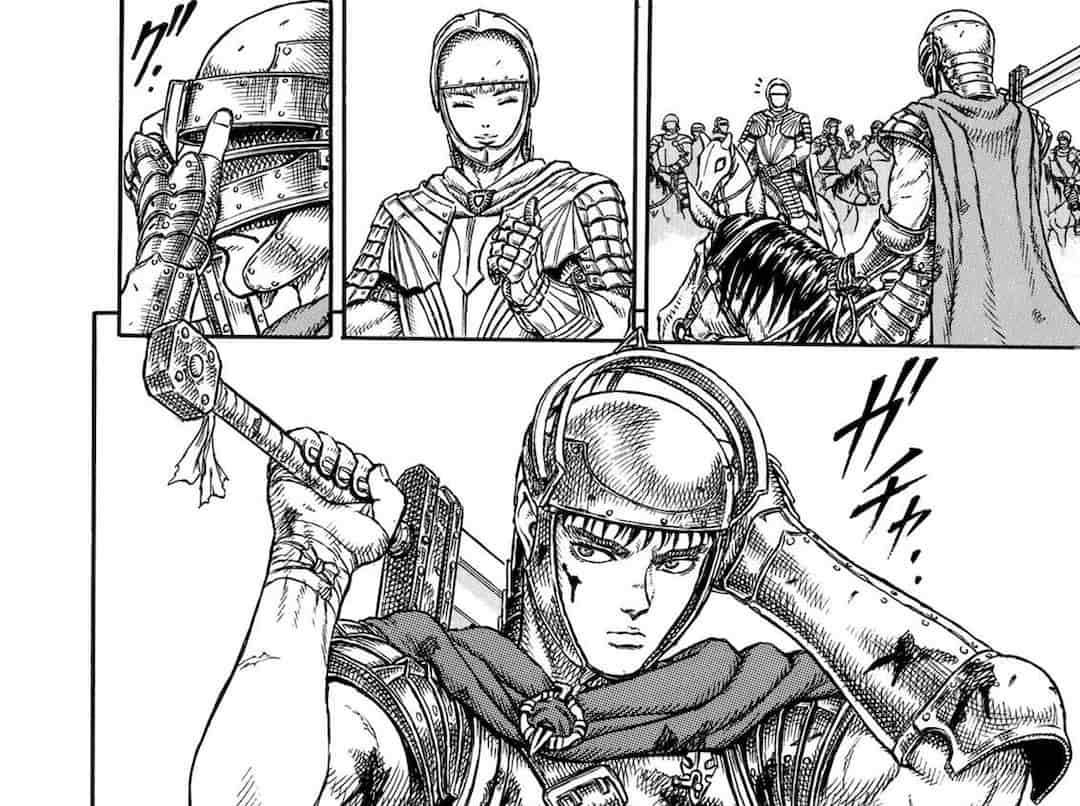

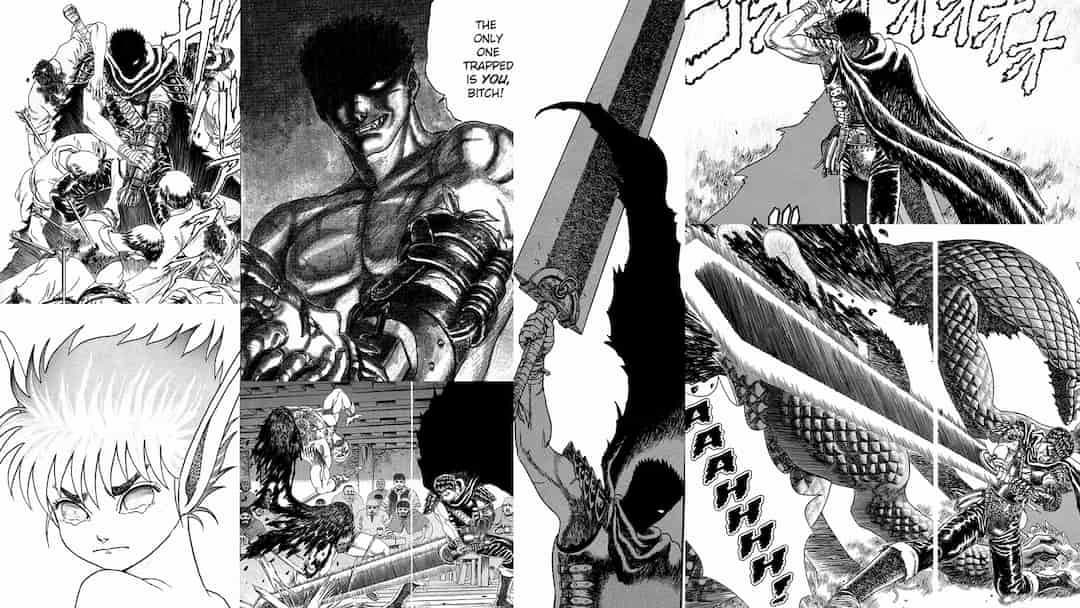

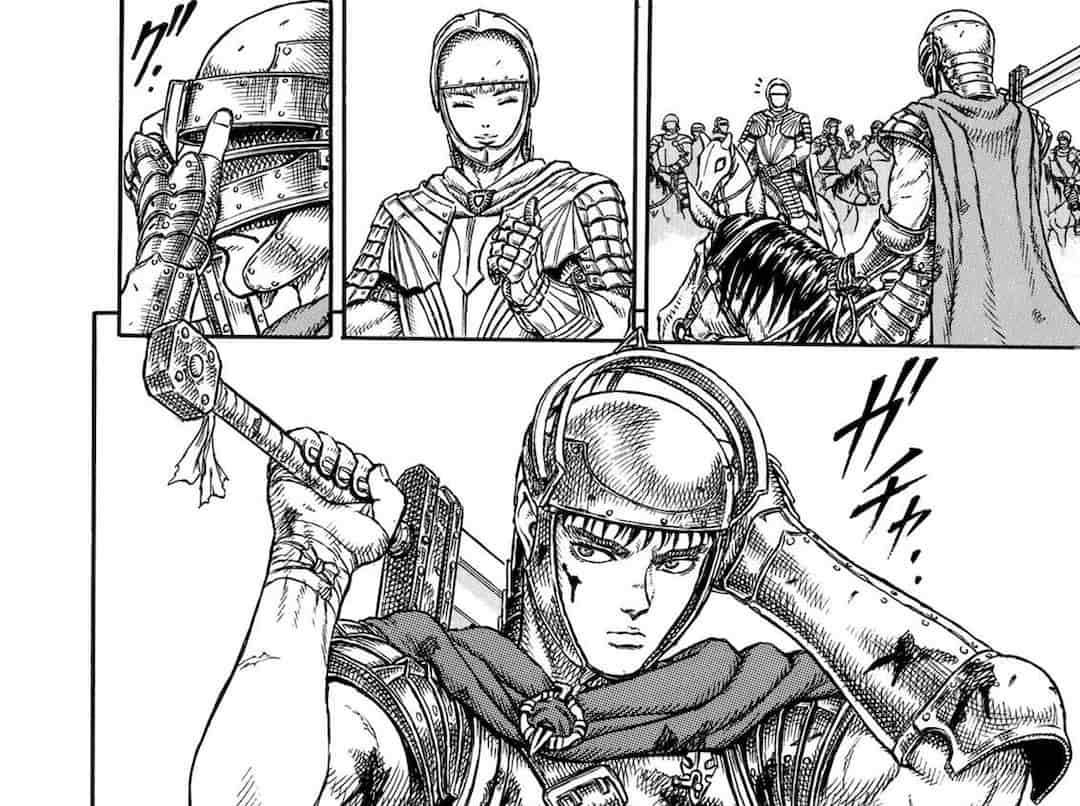

Kentaro Miura’s Berserk is widely hailed as one of the most influential series in the powerful dark fantasy genre in manga history. From its stunning art to its deep philosophical…

Manga has the incredible ability to captivate readers right from the start. One of the most legendary series, Berserk, created by Kentaro Miura, is mainly known for its gripping and…

Kentaro Miura’s Berserk is a masterpiece that looks deeply into the complexities of human emotions, dark fantasy, and psychological horror. Right from the very first page of Berserk, readers are…

Legal fees in personal injury cases can initially seem overwhelming, especially when dealing with the aftermath of an injury. However, understanding how these fees are determined is crucial for making…

Thailand’s tourism industry is noticeably the core driver of its whole economy, as it alone attracts an enormous number of visitors every year, surpassing millions, including revenue generation. As global…

Get ready to embark on an exhilarating journey into the world of manga with Berserk! Created by the late Kentaro Miura, this groundbreaking series has captivated readers with its compelling…

Kentaro Miura’s Berserk is widely regarded as a masterpiece in the manga world. Its compelling storytelling, complex characters, and dark tone make it stand out. Miura’s skilful visual storytelling through…

The first page of Berserk is not just an introduction to a story; it’s a total immersion into a dark, gritty, and brutally unforgiving world. From the moment readers lay…

Running an ecommerce business may seem fun and profitable, but it has its own set of financial challenges to tackle. From managing operational costs to fluctuating revenue streams, ecommerce entrepreneurs…

In the age of the short attention span, getting recognition from an audience is harder than ever, and brands are always on the lookout for the next big thing in…

Prologue to Jim Wendler’s Legacy Jim Wendler is a name that resonates with anyone deeply committed to strength training and mental toughness. As a former powerlifter, coach, and creator of…

As e-commerce expands, many sellers, particularly from Singapore, are eyeing the lucrative U.S. market. Amazon has emerged as a prime platform for these businesses, offering a vast customer base and…

Singapore, a vibrant city-state known for its unique blend of cultures, is a dynamic place for ex-pats to explore. Whether you’re new to the city or have been living here…

On July 31, 2024, Singapore and the United States formalized a significant nuclear cooperation agreement, known as a “123 Agreement,” during a meeting between U.S. Secretary of State Antony Blinken…

Alibaug, a picturesque coastal town in Maharashtra, has become a popular weekend getaway for city dwellers seeking a break from the hustle and bustle of urban life. With its pristine…

Jack Doherty, a prominent YouTuber and social media influencer, was inspired to start his YouTube channel at a young age, driven by his passion for creativity and entertainment. His journey…

Jack Doherty, born on October 8, 2003, in Long Island, New York, is a prominent American YouTuber and social media influencer. Known for his daring stunts, engaging content, and entrepreneurial…

Information Details Full Name Theodor Capitani von Kurnatowski Birth Date March 19, 1980 Birth Place Covington, Louisiana Education Louisiana State University, Loyola University New Orleans, University of Arizona, College of…

Metric Value Estimated Net Worth $60 million Primary Income Source YouTube channel ad revenue YouTube Channel Name Jack Doherty YouTube Subscribers Over 14.3 million YouTube Views Over 5.4 billion total…

In today’s fast-paced world, it’s essential to take a break from the hustle and bustle and focus on our physical and mental well-being. A yoga retreat is an excellent way…

Rishikesh, the spiritual hub of India, is renowned for its rich yogic heritage and the birthplace of yoga. The city is home to numerous yoga schools and ashrams that offer…

Category Key Points Early Life – Born into a family of modest means– Exhibited entrepreneurial spirit from a young age– Early experiences laid foundation for success Career Journey – Co-founder…

Information Details Primary Source of Net Worth CEO of Novelty Dept Store Pte Ltd, a company based in Singapore Ownership Stake in Novelty Dept Store Pte Ltd Significant portion of…

Category Details Birth Year 1968 Education – Bachelor of Medicine and Bachelor of Surgery (MBBS), National University of Singapore (NUS), 1992– Master of Medicine (Ophthalmology), NUS, 1998– Fellow of the…

The automotive industry is constantly evolving, driven by advancements in technology and innovations in manufacturing processes. One crucial aspect of this evolution is the role of adhesives, which have become…

Nepal, a country nestled in the Himalayas, has long been a hub for spiritual seekers and adventure enthusiasts. With its rich cultural heritage and breathtaking landscapes, Nepal offers a unique…

The vegan startup boom is transforming the global food industry, driven by a combination of factors including ethical concerns, environmental awareness, health consciousness, a growing vegan population, and government support.…

Category Information Birth Year 1958 Nationality Canadian Education Dropped out of the University of Vermont Career Co-founded Colby International Limited, served as CEO and president from 1986 to 2000, later…

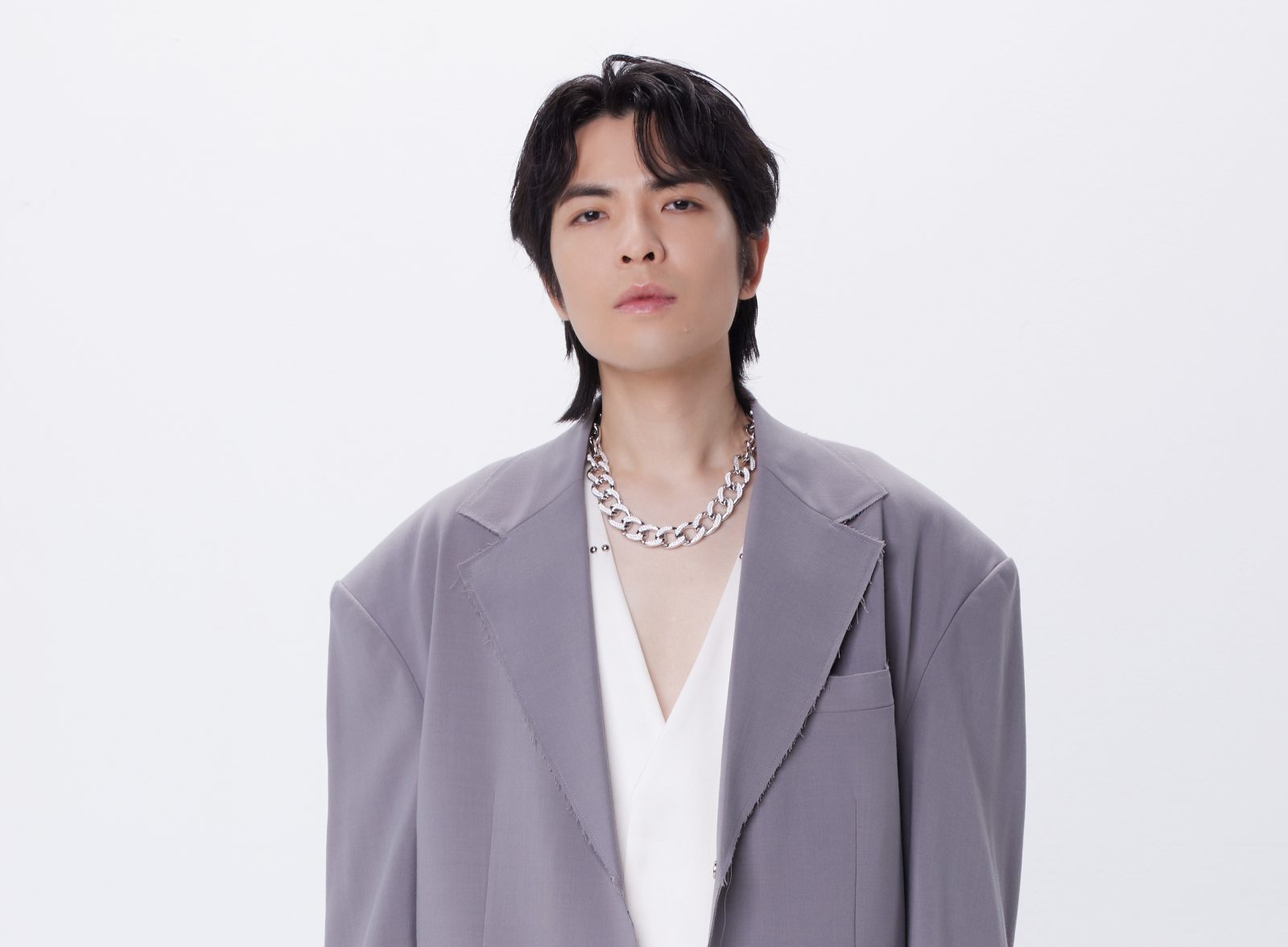

Category Information Basic Information Born on 30 March 1987 in Hualien, Taiwan, Jam Hsiao is a celebrated Taiwanese singer-songwriter and actor. Career Start Began his career as a restaurant singer…

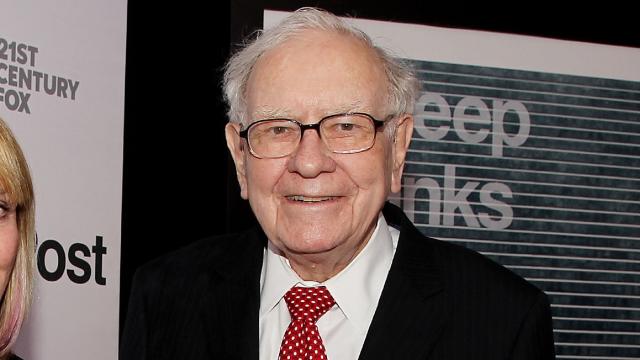

Warren Buffett, the renowned billionaire investor and CEO of Berkshire Hathaway, is known for his shrewd business acumen and philanthropic endeavors. While his business ventures and investments have garnered significant…

Category Information Born August 2, 1948, Brooklyn, New York, USA Famous Role Radio talk show host, writer, and commentator Early Challenges Grew up in a Modern Orthodox Jewish household, struggled…

Category Information Born October 12, 2001 Famous Role Trailer Parker in “Heathers” (TV Series, 2018) Early Challenges Lost her brother to cardiac arrest at age 5, was shy and homeschooled…

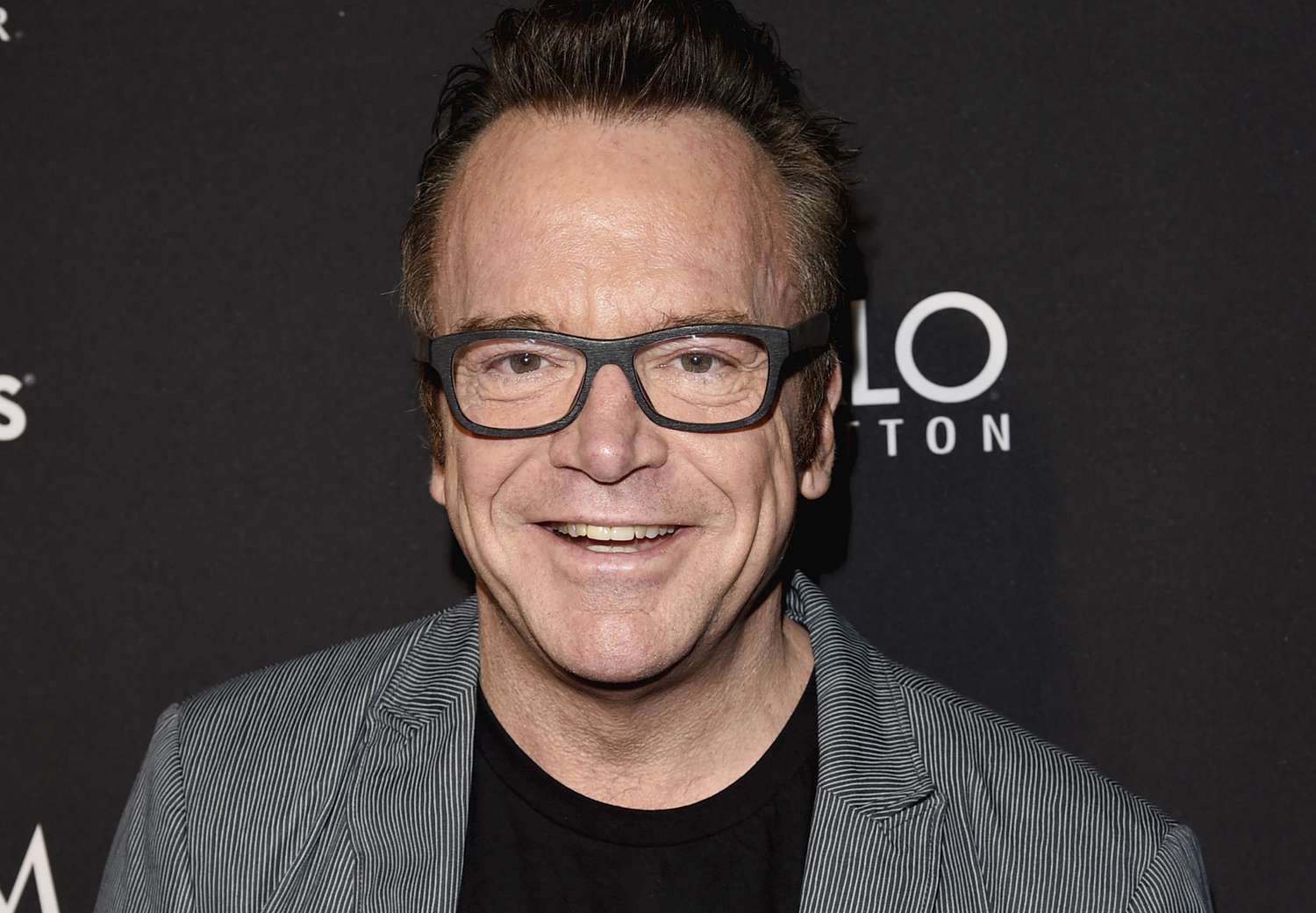

Category Information Born Thomas Duane Arnold on March 6, 1959, in Ottumwa, Iowa, U.S. Famous Role Known for Arnie Thomas in Roseanne, and films such as True Lies, Nine Months,…

Information Details Born Adolph Robert Thornton Jr., July 27, 1985, Chicago, Illinois, U.S. Died November 17, 2021, Memphis, Tennessee, U.S., at age 36 Rise to Fame First gained major attention…

Get weekly insights on business, finance, and smart money strategies delivered directly to your inbox.

No spam. Unsubscribe anytime.

Find exactly what you're looking for